EthiFinance Ratings, an independent European credit rating agency, upgrades the rating of the Republic of Portugal from BBB+ to A-, with an outlook change from Positive to Stable, driven by both methodological changes and improvements in the country’s fundamentals, including the swift return to fiscal surpluses following the pandemic, a positive macroeconomic environment, and a strong ESG assessment, underlining the capacity and commitment to meet financial obligations.

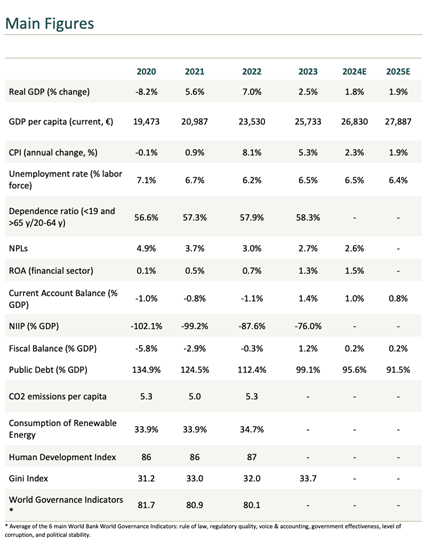

Specifically, EthiFinance Ratings projects growth rates of 1.8% for 2024 and 1.9% for 2025, though these figures remain below the potential growth rate of 2.2% estimated by the European Commission. In addition, the agency expects unemployment to remain stable, with projections of 6.5% for 2024 and 6.4% for 2025, according to the European Commission, as a result of an increase in the labor force, while employment rates continue to evolve positively, reaching a historic high of 75.3% in 2023.

The report also highlights the swift correction of public account imbalances following the pandemic, resulting in a fiscal surplus of 1.2% of GDP in 2023. This rapid adjustment was driven by a strong economic recovery, increased tax revenues, and the gradual phase-out of pandemic-related expenditures. While this surplus is expected to moderate, it is projected to remain positive in 2024 and 2025 (0.2% for both years, according to the IMF). In this context, fiscal prudence is contributing to a reduction in public debt levels, which reached 99.1% of GDP in 2023. However, public debt remains high, posing one of the primary constraints on the country’s rating.

Furthermore, wealth levels remain modest, with a GDP per capita around 60% of the Eurozone average, and according to the study, the country faces significant demographic challenges, with an aging population that could create increased fiscal pressures and impact growth potential. At the same time, the agency expects public investment to increase, supported by the ongoing implementation of the Recovery and Resilience Plan.

On the external front, Portugal’s situation is favorable due to its inclusion in the Eurozone and consistent current account surpluses. However, the study warns that “its status as an international debtor acts as a constraint on its credit rating”, as its net international investment position (-76% in 2023) still reflects the macroeconomic imbalances from the 2008 crisis. Therefore, EthiFinance Ratings notes that Portugal’s high level of external debt remains a concern, leaving the country vulnerable to external shocks”.

On the other hand, the Portuguese banking sector is in a strong position, “with solid capitalization and a CET1 ratio of 17.1% in 2023”, and a reduction in the non-performing loan (NPL) ratio, despite the ECB’s stringent monetary policy, which have benefited Portuguese institutions, with the return on assets (ROA) rising from 0.7% in 2022 to 1.5% in the first half of 2024. However, the report states that “these strengths are counterbalanced by the risks of credit overheating”, which, along with limited international influence and a GDP projection that remains below its potential, exert downward pressure.

In the ESG policy domain, the favorable assessment is supported by Portugal’s solid institutional framework and high governance standards, as well as a high level of social well-being. However, the study warns that “the ESG assessment is constrained by the environmental pillar”, which faces certain risks, especially regarding the green transition, as the country still presents high CO2 emissions levels.

Regarding social policies, the report highlights that “income and gender inequality slightly weaken Portugal’s social profile”. In 2023, the country recorded a Gini Index of 33.7 compared to 32 in 2022, influenced by the rising cost of living. Furthermore, gender disparities persist, with a 15.3 percentage point gap in employment between men and women during the same period, and EthiFinance Ratings points to rising housing prices as a significant challenge.

In terms of governance, the study underscores that “Portugal’s institutional quality and government effectiveness are high”, as demonstrated by the successful implementation of structural measures that have helped the country recover from the 2010 debt crisis. However, the report points to some persistent risks, such as the significant bureaucracy faced by businesses and the lingering presence of corruption, “which can discourage investment and erode trust in institutions”.