The credit rating scale below and their corresponding descriptions are applicable to all of EthiFinance Ratings’ long-term issuer ratings regardless of the asset class. They are also used to rate specific long term debt issues.

An issuer or issue rated in this category displays a maximum capacity to honour its financial commitments.

An issuer or issue rated in this category maintains an excellent capacity to honour its financial commitments even under adverse changes in the economic environment.

An issuer or issue rated in this category displays a high capacity to honour its financial commitments. However, this rating may deteriorate under adverse changes in the economic environment more so than the higher rated categories.

An issuer or issue rated in this category displays an adequate capacity to honour its financial commitments. However, this capacity is more likely to deteriorate under adverse changes in the economic environment than the higher rated categories.

This category is the first to incorporate speculative characteristics. As such, an issuer or issue rated in this category displays a medium capacity to honour its financial commitments constrained by exposure to adverse business, financial or economic conditions. The materialisation of these constraints could lead to a weakened capacity of the issuer or issue to meet its financial obligations.

An issuer or issue rated in this category indicates that a material default risk is present, but the obligor may still display the capacity to honour its financial commitments in the short-term.

However, adverse economic, financial, or business conditions will probably impair the issuer’s ability to meet its financial commitments.

An issuer or issue rated in this category is undergoing problems in honouring its financial commitments and therefore relies on favourable economic and financial conditions.

This category denotes a heightened likelihood of default over the next 12 months.

An issuer or issue rated in this category currently displays uncertainty in honouring its financial obligations with a high probability of missing some of its payments.

This category denotes a heightened likelihood of default over the next 6 months.

An issuer or issue rated in this category displays a high risk of interrupting payments and entering default.

This rating is used when a default has been announced (a distressed exchange or equivalent) but has not yet happened. Default is expected to occur in a maximum time horizon of one month.

For further detail see our Default Definition.

For structured finance transactions, the above scale is also applicable. The ratings will be accompanied by a (sf) suffix to indicate that the instrument being rated belongs to the structured finance asset class. Consequently, this rating scale with the (sf) suffix is applicable to the various tranches of a collateralized security that an SPV issues depending on how the waterfall mechanism distributes amongst each of the tranches the funds generated by the underlying pool of assets.

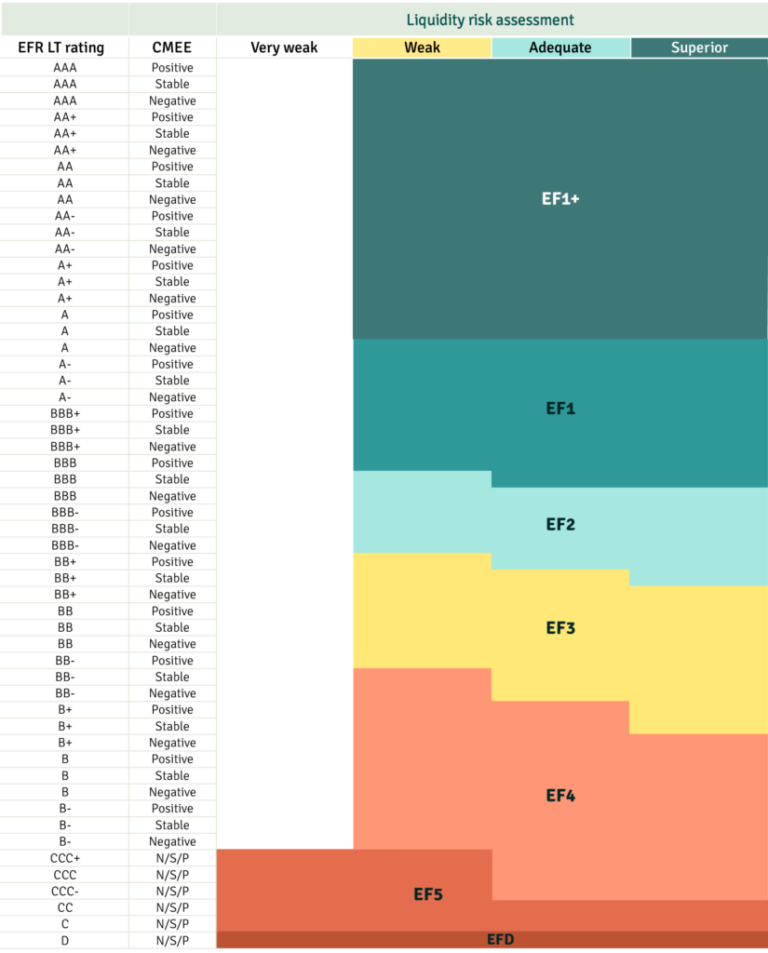

Following are EthiFinance Ratings’ rating definitions and the scale that is used for short-term credit ratings, and also applies to instruments that have a maturity of less than 18 months.

The rating scale below and their corresponding descriptions are applicable to all of EthiFinance Ratings’ short-term issuer ratings for all asset classes except for structured finance and project finance transactions. They are also used to rate specific debt issues.

The issuer or issue displays the highest capacity for the payment of its short-term debt obligations.

The issuer or issue displays a high capacity for the payment of its short-term obligations.

The issuer or issue displays an adequate capacity for the payment of short-term obligations.

This rating is the first to incorporate speculative features. Ratings in this category display, under normal conditions a medium capacity of the issuer to honour its financial commitments even though they incorporate credit weaknesses. Adverse business, financial or economic conditions could lead to an inadequate capacity of the issuer or issue to meet its financial obligations.

The issuer or issue displays a low capacity for the timely payment of short-term debt obligations, and maintains an increased risk compared with higher credit rating instruments.

The issuer or issue displays an insufficient capacity for the timely payment of short-term debt obligations. These issuers / instruments are susceptible to fall into default and may be undergoing in or out-of-court restructurings.

The issuer has defaulted on its short-term financial obligations partially or fully.

An issuer or an issue is considered to be in default when any of the following occurs:

EthiFinance Ratings’ credit ratings can be classified as solicited or unsolicited.

Solicited ratings

Solicited credit ratings are those requested by the rated entity (issuer or issue). The issuer actively collaborates in the process with both public and private information.

Unsolicited ratings

Unsolicited credit ratings are those that are not initiated at the request of the rated entity. The entity is rated by decision of the credit rating agency or upon the request of a third party. The rating is assigned without the participation of the rated entity, with only public information in the case of public ratings, and with private information in the case of private ratings.

EthiFinance Ratings’ outlooks reflect the credit rating agency’s opinion of the probable direction of a rating over the medium term. There are four categories of rating outlooks:

In addition, positive, negative, or evolving outlooks do not always result in a rating change.

After the assignment of an outlook, the timing of a possible rating change is not pre-defined as it is subject to a number of factors, all of which could influence a company’s credit metrics and thereby result in a rating action. However, we estimate that there is usually a period of 9 to 24 months between the assignment of an outlook and the resulting rating change, if any, unless there is new information which could lead to an earlier rating action. In any case, outlooks are, like ratings, subject to an on-going review.

EthiFinance Ratings’ outlooks apply to long-term ratings with the exception of structured finance ratings. By definition, short-term ratings and short-term instruments do not have rating outlooks.

When an event that could change the rating of a company occurs, but EthiFinance Ratings lacks enough information or needs further analysis to review its rating, it may decide to put the rating under review.

The label ‘under review’ is a temporary classification by which the credit rating agency informs stakeholders of an upcoming rating action. When a rating is put under review, the current rating and outlook remain valid until the next rating action.

Unlike outlooks, ratings under review will usually result in a rating action in the coming three to six months once the review has been announced, but may sometimes last longer when EthiFinance Ratings is expecting further guidance and information in order to assign its ratings.

Events which may trigger such reviews are:

Ratings under review may result in an upgrade, a downgrade, or no change for the rating and/or the outlook, based on the analysis performed by EthiFinance Ratings.

Whenever EthiFinance Ratings ceases to rate an entity, an issue or a structured product, such entities, along with their ratings shall be withdrawn.

The following are instances that lead to a withdrawal of a company’s rating:

The withdrawal action is duly notified in the same manner as all other rating actions.