The Taxonomy Regulation has gradually come into force for companies and investors since 2021. EthiFinance offers various services to support its clients - companies and investors - in their regulatory compliance or voluntary reporting on the Taxonomy.

Since 2004, the EthiFinance Group has established itself as a specialist in ESG ratings of European SMIDs by developing its regulatory expertise and ESG research. Its position as a double materiality agency and its expertise regarding issues related to each stakeholder enable it to provide tailored offers to investors and corporates.

The technical, regulatory and sectoral expertise of EthiFinance analysts and consultants allows the Group's clients to fully grasp the Taxonomy as a reference framework for defining sustainable activities.

In addition to its expertise in the SMID segment, EthiFinance covers a universe of nearly 20,000 stocks thanks to an external ESG data provider, enabling it to expand its Taxonomy coverage and conduct Taxonomy KPI analyses on portfolios composed of large capitalizations.

Our offer for companies

Based on documentary analysis and discussions with the company, EthiFinance delivers a comprehensive report, presenting the level of eligibility and/or alignment of the company's activities with the Taxonomy. This report includes:

- The breakdown in % of the turnover with regard to the Taxonomy (degree of eligibility, or even alignment)

- Qualitative and quantitative arguments supporting these assignments

- Recommendations for improving the Taxonomy KPIs

Example of deliverable:

- Taxonomy report

- Lotta Marchal, Manager Sustainable Financing - lotta.marchal@ethifinance.com

- Anne Chanon, Director of the Corporate Division (CSR & Sustainable Financing) - anne.chanon@ethifinance.com

Our offers for investors

Reporting offer

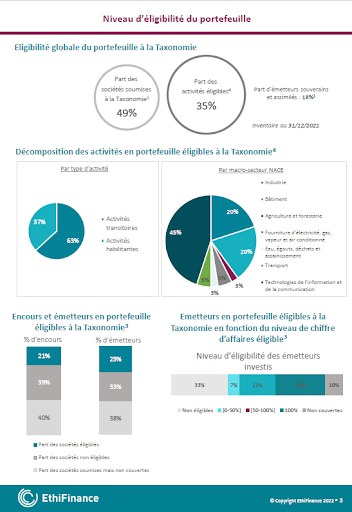

EthiFinance's Portfolio Reporting & Analysis service provides quantitative eligibility and Taxonomy alignment reporting to enable investors with directly held assets to meet the regulatory requirements of SFDR (for Article 8 and Article 9 funds), Article 29 LEC (Sustainable Activities) and the Taxonomy Regulation (EU) 2020/852.

This solution allows investors to highlight:

- The share of portfolio companies required to disclose their eligibility and alignment

- The share of outstanding assets eligible and aligned to the Taxonomy

- The share of portfolio activities contributing to objectives 1 and 2 of the Taxonomy regulation, with a sectoral breakdown for some of these elements

Example of deliverable:

- Quantitative eligibility and alignment reporting

- Possibility to combine Taxonomy reporting with global climate reporting (carbon footprint and intensity, 2°c alignment, environmental footprint)

- Art.29 compliance reporting (inclusion of main Taxonomy indicators with distinction on different listed asset classes)

Key contacts:

- Diane Fleury, Manager Reporting & Portfolio Analysis - diane.fleury@ethifinance.com) / reporting@ethifinance.com

Consulting and training

EthiFinance assists investors in the definition, formalization and implementation of their responsible investment strategy with respect to the Taxonomy. Its team of consultants offers tailor-made solutions to integrate the analysis of eligibility and alignment with the Taxonomy in portfolios. The team dedicated to regulatory monitoring and analysis can also help investors anticipate the entry into force of the Taxonomy's six environmental objectives, or to articulate the SFDR classification of their product with the Taxonomy.

Example of deliverable:

- Taxonomy-specific analysis frameworks

- Regulatory reporting

- Definition of responsible investment strategies aligned with the Taxonomy

- Regulatory training

- Xavier Leroy, Head of Advisory Services - xavier.leroy@ethifinance.com

EthiFinance ESG Ratings offer

Thanks to EthiFinance ESG Ratings, its ESG rating agency specialised in ESG ratings of listed European SMEs, the EthiFinance group collects directly from companies their share of turnover, CapEx and OpEx eligible for and aligned with the Taxonomy. From the implementation of the Taxonomy Regulation in 2021 on, this data has been updated every year and made available to the Group's investor clients at the end of the annual data collection campaign.

In addition, EthiFinance has developed an internal methodology to estimate the share of revenues, CapEx and OpEx eligible for the Taxonomy of companies that have not yet reported on these indicators. This data is available to investor clients and covers more than 2,300 listed European companies.

Beyond eligibility, EthiFinance has developed a methodology to estimate the potential alignment with the Taxonomy of companies in its universe based on the substantial contribution criteria. This first estimation already allows us to identify, within our universe, nearly 180 companies with an alignment potential higher than 50% and about a hundred companies with an alignment potential between 10% and 50%. We consider that, in the spirit of the Taxonomy regulation, the analysis of externalities - Do No Significant Harm (DNSH) criterion - can only be performed during a qualitative analysis.

Examples of deliverables:

- Share of revenue, CapEx and OpEx eligible for and aligned with the Taxonomy as reported by 2300 European listed stocks in Excel format

- Estimation of the eligibility by quartiles and by revenue bands of 2300 European listed companies in Excel format

- Estimation of the potential turnover aligned with the Taxonomy in Excel format

- Camille Ferron, Manager EthiFinance ESG Ratings - camille.ferron@ethifinance.com

Predictive opinion

EthiFinance offers a qualitative and prospective analysis of the alignment with the Taxonomy of 100 small and mid caps.

This solution offers investors an answer to two questions:

- Will the company I want to invest in be more than 50% aligned by 2025?

- Can I invest in a strategy that will improve the company's alignment with the Taxonomy, and that will contribute to improving the company's environmental performance?

Example of deliverable:

- 4-5 page report on the Taxonomy alignment of 100 companies, with an alignment forecast and strategic positioning matrix

OneTrack offer

OneTrack, a division of EthiFinance specialising in the monitoring of ESG performance for unlisted assets, offers a solution for estimating the eligibility and alignment of a portfolio to meet the regulatory needs of investors.

This methodology is based on an analysis of the company's activities combined with a review of specific Taxonomy criteria. In the absence of specific data provided by the company, our model allows us to estimate the proportion of sales eligible for and aligned with the Taxonomy.

Covering all asset classes, this solution offers the ability to identify eligibility and alignment data on any type of asset and company.

Example of deliverables:

- Regulatory / qualitative reporting

- Xavier Leroy, Head of Advisory Service - xavier.leroy@ethifinance.com

- Bastien Guerrier, Head of Operations - One Track. bastien.guerrier@ethifinance.com

- OneTrack Team - onetrack@ethifinance.com